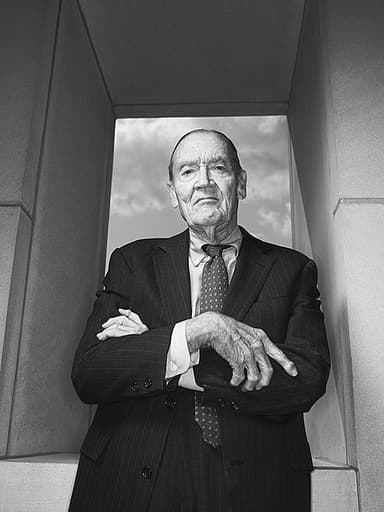

John Bogle

Born 1929 · Age 97

American investor, founder of The Vanguard Group, pioneer of index funds, bestselling author and philanthropist.

Compare Your Trajectory

See how your career milestones stack up against John Bogle and other industry leaders.

Life & Career Timeline

Born in Montclair, New Jersey

John Clifton Bogle was born in Montclair, New Jersey to William Yates Bogle, Jr. and Josephine Lorraine Hipkins.

Graduated Blair Academy

Graduated Blair Academy cum laude after transferring there on a work scholarship (had earlier attended Manasquan High School).

Entered Princeton University

Accepted to Princeton University to study economics and investment.

Graduated Princeton University magna cum laude

Earned a BA in Economics; wrote a 130-page senior thesis 'The Economic Role of the Investment Company' which later caught the eye of Wellington's founder.

Hired by Wellington Management Company

Walter L. Morgan hired Bogle at Wellington Fund after reading his senior thesis; start of his investment career.

Married Eve Sherrerd

Bogle married Eve Sherrerd; they would have six children.

Helped launch Windsor Fund (Wellington equity fund)

Persuaded Wellington to start an equity fund to complement the Wellington Fund; Windsor Fund debuted in 1958.

First cardiac arrest

Suffered his first of several cardiac arrests at age 31, a significant health milestone in his life.

Promoted to Administrative Vice President at Wellington

Advanced into senior management at Wellington Management Company (administrative VP).

Promoted to Executive Vice President at Wellington

Continued ascent in executive ranks at Wellington Management.

Diagnosed with arrhythmogenic right ventricular dysplasia

At age 38 he was diagnosed with the rare heart disease arrhythmogenic right ventricular dysplasia (ARVD).

Became President of Wellington (approx.)

Moved into the president role at Wellington Management (sources place senior leadership in the late 1960s).

Led merger of Wellington with TDPL

Led Wellington's merger with Thorndike, Doran, Paine & Lewis (TDPL); later disputes from the merger precipitated his departure and the Vanguard experiment.

Chairman, Board of Governors of the Investment Company Institute

Served as chairman of the ICI board of governors (1969–1970); active industry leadership role.

Appointed chairman of Wellington's mutual funds; later fired over merger dispute

Replaced Walter Morgan as chairman of Wellington's mutual funds in 1970; was later removed/ousted after management disputes related to the merger — a turning point motivating the creation of Vanguard and index funds.

Chair, Investment Companies Committee of NASD (approx.)

Served as chairman of the Investment Companies Committee of the National Association of Securities Dealers (now FINRA) from 1972 to 1974.

Founded The Vanguard Group (formed)

Formed The Vanguard Group (the 'Vanguard Experiment') following disputes at Wellington; created a mutual, investor-owned structure built to operate 'at cost'.

Introduced concept of index mutual fund at Vanguard

Bogle introduced the first index mutual fund concept at Vanguard (initial efforts and internal launches in 1975); initially derided as 'Bogle's Folly'.

Index investing ideas popularized

Bogle's advocacy and the Vanguard 500 brought the practical concept of low-cost passive investing to millions — the seed of the index revolution.

Vanguard Group commenced operations

The Vanguard Group of Investment Companies officially commenced operations on May 1, 1975.

Launched First Index Investment Trust / Vanguard 500 Index Fund

Launched the First Index Investment Trust (Vanguard 500 Index Fund), the first index mutual fund for retail investors; initial underwriting raised about $11 million.

Vanguard becomes direct-sold no-load company

Vanguard stopped marketing funds through brokers and offered funds directly to investors, eliminating sales loads and commissions.

John J. Brennan joins Vanguard (future successor)

Hired John J. Brennan as his assistant/second-in-command; Brennan later became Bogle's hand-picked successor.

Launched Vanguard Primecap Fund (Nov 1984)

Met Primecap management and launched the Vanguard Primecap Fund in November 1984 — a collaboration to offer an actively managed fund within Vanguard.

No-Load Mutual Fund Association Outstanding Achievement Award

Recognized by the No-Load Mutual Fund Association with its first Outstanding Achievement Award.

Chairman of Blair Academy Board (approx. span)

Served as chairman of the Blair Academy board of trustees (served as Chairman from 1986–2001), supporting his alma mater.

Sold most of his stocks during dot-com bubble (late 1990s)

In the late-1990s bubble Bogle reduced equity exposure, correctly anticipating weak returns for the following decade and stronger bond returns.

Established The Armstrong Foundation

Founded The Armstrong Foundation to support education, hospitals, his church and United Way, giving back a portion of his earnings.

Published Bogle on Mutual Funds

First major book: Bogle on Mutual Funds: New Perspectives for the Intelligent Investor (1993).

Relinquished role as Vanguard CEO

Passed day-to-day leadership to John J. Brennan (Brennan succeeded him as CEO in early 1996).

Underwent heart transplant

Had a successful heart transplant in 1996 (shortly after stepping down as CEO); returned to work later that year as senior chairman.

Appointed to Independence Standards Board

Named by SEC Chairman Arthur Levitt to serve on the Independence Standards Board in 1997.

Named one of four 'Giants of the 20th Century' by Fortune

Fortune magazine named Bogle as one of the four investment giants of the twentieth century.

Published Common Sense on Mutual Funds

Released Common Sense on Mutual Funds: New Imperatives for the Intelligent Investor; it became a bestseller and a classic in the investment community.

Authored additional Vanguard-era books and continued public speaking

Bogle was an active public speaker and author around the late 1990s and early 2000s, helping disseminate index investing principles.

Chairman, National Constitution Center board (start)

Became chairman of the board of trustees for the National Constitution Center in Philadelphia (served as chairman 1999–2007).

Stepped down from Vanguard board; founded Bogle Financial Markets Research Center

Left the Vanguard board and created the Bogle Financial Markets Research Center (a small research institute on Vanguard's campus).

Published John Bogle on Investing: The First 50 Years

Authored a retrospective on his first 50 years in the investment business.

Published Character Counts: The Creation and Building of The Vanguard Group

Published a book chronicling the building of Vanguard and its culture.

Named Time 100 and received Institutional Investor Lifetime Achievement

Time named him one of the world's 100 most powerful and influential people; Institutional Investor presented a Lifetime Achievement Award.

Elected to the American Philosophical Society

Elected as a member of the American Philosophical Society.

Received honorary doctorate from Princeton

Princeton University awarded him an honorary doctorate in recognition of distinguished achievement.

Received other major honors and awards

Over the 2000s received numerous honors including Legends of Leadership (Yale SOM, 2003) and other institutional honors.

Published The Little Book of Common Sense Investing

Released The Little Book of Common Sense Investing, which became widely influential among individual investors.

Published Don't Count on it!; received Richard J. Davis Ethics Award (2010)

Published Don’t Count On It!: Reflections... and was awarded the Richard J. Davis Ethics Award by IMCA.

Received honorary doctorate from Villanova University

Villanova University awarded Bogle an honorary doctorate (among many honorary degrees he received).

John C. Bogle Legacy Forum celebrated career

In January 2012, financial leaders celebrated Bogle's contributions at the John C. Bogle Legacy Forum.

Bogle Fellowship established at Princeton; received multiple lifetime awards

The Bogle Fellowship was established by his son at Princeton; Bogle received awards including Pennsylvania Society Gold Medal and EY Entrepreneur Of The Year Lifetime Achievement (2016).

Warned about concentration in index fund voting power

Publicly cautioned that the growth of index funds could concentrate corporate voting power in the hands of a few large managers.

Published Stay the Course: The Story of Vanguard and the Index Revolution

Released Stay the Course, recounting Vanguard's history and the index revolution.

Vanguard AUM milestone (reported Dec 31, 2018)

Vanguard reported $4.9 trillion in global assets under management and more than 20 million investors as of December 31, 2018.

Author of 12 books; over 1.1 million copies sold (lifetime)

By late life Bogle had written 12 books, selling over 1.1 million copies worldwide (aggregate lifetime milestone).

Posthumous recognition by Warren Buffett

Warren Buffett publicly credited Bogle with having done more for American investors than any individual he knew.

Died in Bryn Mawr, Pennsylvania

John C. Bogle died at his home in Bryn Mawr, Pennsylvania on January 16, 2019 at age 89.

Key Achievement Ages

Explore what John Bogle and others achieved at these notable ages:

Similar Trajectories

Daniel Kahneman

Born 1934 · Age 92

Israeli-American psychologist and behavioral economist known for work on judgment and decision-making, heuristics and biases, prospect theory; 2002 Nobel laureate; author of Thinking, Fast and Slow.

Tony Hoare

Born 1934 · Age 92

British computer scientist known for Quicksort, Hoare logic, CSP, contributions to programming languages, algorithms, formal verification and concurrency. Turing Award winner (1980); long academic career at Queen's University Belfast and University of Oxford; senior/principal researcher at Microsoft Research, Cambridge.

Carl Sagan

Born 1934 · Age 92

American astronomer, planetary scientist, and science communicator; pioneer in exobiology and SETI, author of popular science books and host of Cosmos.

Mihaly Csikszentmihalyi

Born 1934 · Age 92

Hungarian-American psychologist, creator of the theory of 'flow', Distinguished Professor at Claremont Graduate University, co-founder of the field of positive psychology.

Bob Proctor

Born 1934 · Age 92

Canadian self-help author and motivational speaker, proponent of the law of attraction; best known for You Were Born Rich (1984) and as a contributor/teacher in the film The Secret (2006).

Niklaus Wirth

Born 1934 · Age 92

Swiss computer scientist, designer of Pascal and several other programming languages, Turing Award winner (1984), long-time professor at ETH Zürich and pioneer in programming languages and software engineering.