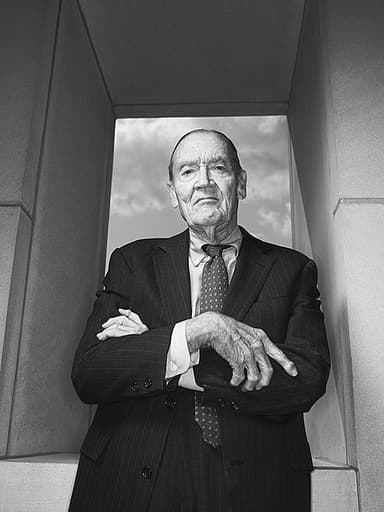

Jack Bogle

Born 1929 · Age 97

American investor, founder and long-time CEO of The Vanguard Group, creator/popularizer of the retail index mutual fund, and author and philanthropist who championed low-cost, long-term investing.

Compare Your Trajectory

See how your career milestones stack up against Jack Bogle and other industry leaders.

Life & Career Timeline

Born in Montclair, New Jersey

John Clifton Bogle born to William Yates Bogle, Jr. and Josephine Lorraine Hipkins in Montclair, New Jersey.

Family harmed financially by Great Depression (family lost wealth)

Bogle's Scottish-American family, previously well-off, lost much of its wealth in the Great Depression — formative childhood hardship.

Parental difficulties and eventual divorce

Father fell into alcoholism; parents divorced — an early personal adversity that shaped family life.

Attended Manasquan High School (partial)

Bogle and his twin brother David attended Manasquan High School near the New Jersey shore for a time before transferring.

Transferred to Blair Academy on scholarship

Transferred to Blair Academy on work scholarships (date approximate based on graduation year), where he excelled in mathematics.

Graduated Blair Academy cum laude

Completed secondary education at Blair Academy, graduating cum laude.

Accepted to Princeton University

Admitted to Princeton University to study economics and investment.

Worked on senior thesis 'The Economic Role of the Investment Company'

Spent junior and senior years researching and writing a 130-page thesis on the mutual fund industry; this thesis notably led to his first job.

Graduated Princeton magna cum laude (BA in Economics)

Graduated from Princeton University magna cum laude in economics (1951).

Hired by Wellington Fund (Walter L. Morgan)

Hired by Walter L. Morgan at The Wellington Fund reportedly because Morgan read Bogle's thesis.

Promoted to Assistant Manager at Wellington

Promoted to assistant manager, enabling him to analyze and influence company investment strategy.

Married Eve Sherrerd

Married Eve Sherrerd (they later had six children).

First recorded cardiac arrest

Suffered his first of several cardiac arrests at age 31.

Diagnosed with arrhythmogenic right ventricular dysplasia (ARVD)

Diagnosed with rare heart disease ARVD at age 38.

Chairman, Board of Governors of the Investment Company Institute

Served as Chairman of the Board of Governors of the ICI (1969-1970) and as a board member from 1969-1974.

Replaced Walter Morgan as chairman of Wellington's mutual funds

After climbing the ranks at Wellington, Bogle replaced founder Morgan as chairman of Wellington's mutual funds.

Fired from Wellington after an ill-fated merger

Fired following approval of what he later called an 'extremely unwise' merger — a key turning point prompting him to found Vanguard.

Founded The Vanguard Group

Founded The Vanguard Group (1974), pioneering a unique mutual ownership structure where fund shareholders effectively own the funds that own the firm.

Introduced first index mutual fund (initially derided)

Introduced the first retail index mutual fund (derided as 'Bogle's Folly'), launching Vanguard's passive-investing revolution.

Launched First Index Investment Trust / Vanguard 500 (retail S&P 500 fund)

Created the First Index Investment Trust, the precursor to the Vanguard 500 Index Fund. In its initial underwriting it raised about $11 million.

Initial Vanguard 500 fundraising (retail S&P 500 fund raised $11M)

The initial underwriting for the Vanguard S&P 500 index fund raised approximately $11 million—an early fundraising milestone for the first retail index fund.

Joined Board of Trustees, The American College of Financial Services

Served on the Board of Trustees of The American College from 1981 to 1987.

Hired John J. Brennan as second-in-command at Vanguard

Bogle hired John J. Brennan (1982) as his handpicked heir and deputy; Brennan later succeeded him as CEO.

Launched Vanguard Primecap Fund (Nov 1984)

Met with Primecap management and launched the Vanguard Primecap Fund in November 1984.

Became Chairman of the Board, Blair Academy (start)

Served as Chairman of Blair Academy's board from 1986 until 2001 (was also a trustee).

Founded The Armstrong Foundation (philanthropy)

Established The Armstrong Foundation to give to schools, hospitals, church, and United Way — philanthropic vehicle.

Published 'Bogle on Mutual Funds: New Perspectives for the Intelligent Investor'

Began publishing bestselling and influential books on mutual funds and investing; this was his first listed major book (1993).

Philadelphia Investment Achievement Award

Received the Philadelphia Investment Achievement Award from the Financial Analysts of Philadelphia (1993).

Relinquished CEO role at Vanguard; underwent heart transplant

Relinquished operational CEO duties in 1996; had a successful heart transplant the same year. John J. Brennan became CEO.

Appointed to SEC's Independence Standards Board

Appointed by SEC Chairman Arthur Levitt to the Independence Standards Board (1997).

Received Award for Professional Excellence (AIMR)

Presented with the Award for Professional Excellence from the Association for Investment Management and Research.

Named one of the four 'Giants of the 20th Century' by Fortune

Fortune designated Bogle as one of the investment industry's four 'Giants of the 20th Century' (1999).

Published 'Common Sense on Mutual Funds: New Imperatives for the Intelligent Investor'

Released what became a bestseller and an investing classic in 1999.

Left Vanguard operationally; moved to Bogle Financial Markets Research Center

Left Vanguard in 1999 and moved to lead the Bogle Financial Markets Research Center located on Vanguard's campus.

Woodrow Wilson Award (Princeton) for distinguished achievement

Received Princeton University's Woodrow Wilson Award for distinguished national service (1999).

Inducted into Hall of Fame of the Fixed Income Analysts Society

Inducted into the Fixed Income Analysts Society Hall of Fame (1999).

Named Pennsylvania's Business Leader of the Year

Recognized by the Commonwealth’s Chamber of Commerce as Pennsylvania’s Business Leader of the Year (2000).

Published 'John Bogle on Investing: The First 50 Years'

Published a retrospective on his career and investing philosophy (2000).

Served as Chairman of the Board, National Constitution Center (start)

Served as Chairman of the Board of the National Constitution Center from 1999 through 2007 (chair start recorded 1999/2000 timeframe).

Vanguard structure recognized as major industry innovation

Vanguard's mutual ownership structure (funds own the firm) became widely recognized as a novel model enabling lower costs for investors.

Published 'Character Counts: The Creation and Building of The Vanguard Group'

Published a book detailing Vanguard's founding and culture (2002).

Remarks before the Harvard Club of Boston (speech)

Delivered remarks at the Harvard Club of Boston on Jan 14, 2003 (public speaking engagement).

Named to Time '100 most powerful and influential people' & Institutional Investor Lifetime Achievement Award

Time magazine named him among the world's 100 most influential (2004); Institutional Investor presented a Lifetime Achievement Award the same year.

Elected to the American Philosophical Society

Elected as a member of the American Philosophical Society (2004).

Total book sales milestone referenced (over career)

By later reports the dozen books Bogle authored sold over 1.1 million copies worldwide (Constitution Center summary).

Received honorary doctorate from Princeton University

Awarded an honorary doctorate by Princeton in recognition of distinguished achievements (2005).

Published 'The Battle for the Soul of Capitalism'

Published a major book on capitalism, corporate culture, and ethics (2005).

Published 'The Little Book of Common Sense Investing'

Published what would become one of his most famous investor-education works (2007).

Ended chairmanship of National Constitution Center (2007)

Concluded service as Chairman of the National Constitution Center in 2007 (chair 1999–2007).

Published 'Enough: True Measures of Money, Business, and Life'

Continued publishing on money, values, and business (2008).

Published 10th Anniversary Edition of 'Common Sense on Mutual Funds' (updated)

Released a fully updated 10th-anniversary edition of his classic (2009).

Published 'Don't Count on it!: Reflections...'

Published 'Don't Count on it!' reflecting on investment illusions and broader themes (2010).

Received honorary doctorate from Villanova University

Received an honorary doctorate from Villanova (2011).

John C. Bogle Legacy Forum celebrated his career (Jan 2012)

A forum was held in January 2012 honoring Bogle's career and contributions to the investment industry.

Published 'The Clash of the Cultures: Investment vs. Speculation'

Published a book debating investment culture vs. speculation (2012).

Received Consumer Advocate Award from Retirement Income Industry Association (introductory mention)

Was introduced/recognized and had received the Consumer Advocate Award (faculty intro referenced awarding him in 2014).

Bogle Fellowship established at Princeton (by his son)

The Bogle Fellowship was established at Princeton University by John C. Bogle Jr., sponsoring 20 first-year students in each class.

Public comment on President Trump's policies

Stated that Trump's policies were good for markets short-term but dangerous for society long-term (public political commentary).

Published 2017 edition of 'The Little Book of Common Sense Investing' (10th Anniversary updated)

Released the updated 10th anniversary edition (2017).

Published 'Stay the Course: The Story of Vanguard and the Index Revolution'

Published a book recounting Vanguard's history and the index revolution (2018).

Warned publicly about index funds concentrating corporate voting power

Sounded a warning (Wall Street Journal/press) that passive indexing concentration could give too much voting power to a few firms (Vanguard, BlackRock, State Street).

Warren Buffett tribute

Following Bogle's death, Warren Buffett publicly credited Bogle with doing more for American investors than any individual he'd known.

Estimated net worth at death (~$80M)

Investopedia and other reports estimate John Bogle's net worth at approximately $80 million at the time of his death in 2019.

Died at home in Bryn Mawr, Pennsylvania

John C. Bogle died on January 16, 2019 at age 89.

Key Achievement Ages

Explore what Jack Bogle and others achieved at these notable ages:

Similar Trajectories

Daniel Kahneman

Born 1934 · Age 92

Israeli-American psychologist and behavioral economist known for work on judgment and decision-making, heuristics and biases, prospect theory; 2002 Nobel laureate; author of Thinking, Fast and Slow.

Tony Hoare

Born 1934 · Age 92

British computer scientist known for Quicksort, Hoare logic, CSP, contributions to programming languages, algorithms, formal verification and concurrency. Turing Award winner (1980); long academic career at Queen's University Belfast and University of Oxford; senior/principal researcher at Microsoft Research, Cambridge.

Carl Sagan

Born 1934 · Age 92

American astronomer, planetary scientist, and science communicator; pioneer in exobiology and SETI, author of popular science books and host of Cosmos.

Mihaly Csikszentmihalyi

Born 1934 · Age 92

Hungarian-American psychologist, creator of the theory of 'flow', Distinguished Professor at Claremont Graduate University, co-founder of the field of positive psychology.

Bob Proctor

Born 1934 · Age 92

Canadian self-help author and motivational speaker, proponent of the law of attraction; best known for You Were Born Rich (1984) and as a contributor/teacher in the film The Secret (2006).

Niklaus Wirth

Born 1934 · Age 92

Swiss computer scientist, designer of Pascal and several other programming languages, Turing Award winner (1984), long-time professor at ETH Zürich and pioneer in programming languages and software engineering.